When applying for Social Security disability benefits, it’s good to think about why your claim could be denied. Being aware of the reasons for a disability denial helps you avoid mistakes and brings you closer to a successful disability application.

We take a close look at some of the most common reasons why Social Security denies disability claims, so you can avoid them in your own application.

How Many Disability Claims Are Denied?

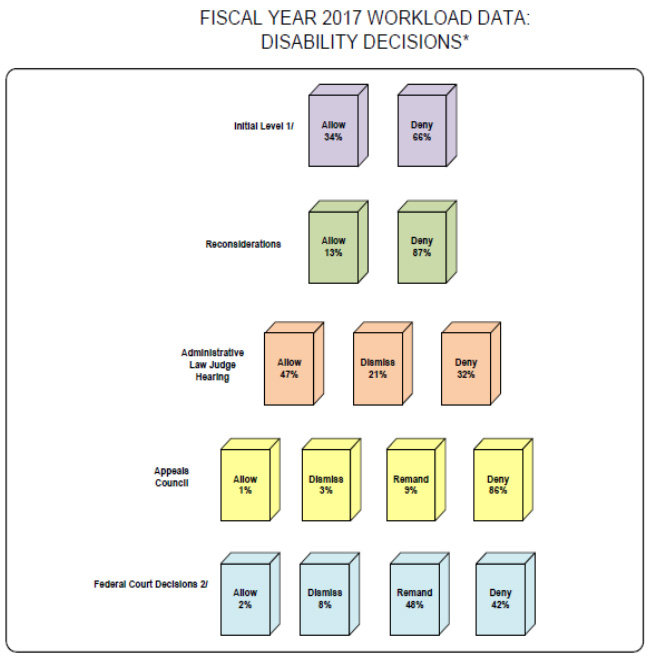

A huge percentage of disability claims are rejected each year. We see this clearly in the commonly-called ‘waterfall chart’ of the Social Security Administration

This chart shows that in 2017, Social Security denied 66 percent of initial disability applications.This means that only a third of all the applicants nationwide made it through on their first try. Among those that tried for reconsideration, a whopping 87 percent were rejected. Even when claimants reached the Administrative Law Judge hearing stage, 32 percent of them were still rejected.

These numbers tell us important things. One is that denials and appeals are very common in the disability application process. If you find yourself facing a rejection on your first or second try, it is not a reason to give up. Instead, it is a chance to improve your claim by eliminating the reasons it was denied.

Another takeaway is that it is extremely important to take steps to make sure your application is complete and effective – whether it’s an initial claim or an appeal. One simple error can be reason for rejection, especially in the reconsideration stage where only 13 percent make it through. To pass this strict process, you want to be thorough and mindful in putting together your application. The guidance of a disability lawyer can greatly help you with this.

Common Reasons For Disability Denial

Lack of medical evidence

Solid medical evidence is crucial to prove that you have a disabling condition that prevents you from working. Some people wrongly assume that the SSA provides doctors who will gather the needed medical evidence for each claimant. In truth, you must compile this evidence yourself, even if, in some cases, Social Security asks you to go for a medical exam.

Present your claims representative with up-to-date medical records and related documents. As much as possible, include physician’s notes that indicate your specific limitations or reasonswhy you should be excused from your work. Also keep a record of your missed work days due to your disability.

Your income exceeds the limit

The SSA looks at whether you have substantial gainful activity (SGA) – that is, whether you are able to work and earn enough money. If you do, your benefit claim will be denied. The SGA income limit changes every year, and for 2019, it is at $1,220 per month.

With limited exceptions, if you’re applying for Social Security Disability Insurance (SSDI), you must not exceed this SGA income limit.

If you’re applying for Supplemental Security Income (SSI), you have to be mindful of the SGA limit, as well as other non-work-related income limits. The SSI program actually limits both earned and unearned income. Note that ‘income’ here even includes income that is not earned such as Social Security benefits, pensions, State disability payments, unemployment benefits, interest income, dividends and cash from friends and relatives.. The SSA has a full explainer here.

The disability isn’t severe enough or long-lasting enough

Social Security strictly follows the guidelines listed in the famous “Blue Book.” It lists the different areas of disability and the criteria to consider each condition severe. If a medical condition does not meet these criteria, it will very likely be denied benefits. Even if you establish that you have some level of disability, but it does not satisfy the Blue Book criteria, you can expect a denial.

Likewise, the SSA has a rule that the disability must last at least 12 months or result in death. Only one disability is exempted from this duration rule, and that is blindness. If your non-blind condition is expected to heal in less than a year, your disability claim may be denied.

Of course, the SSA evaluates each case individually instead of generalizing it. For example, bone fractures usually heal within a few months. But if your broken bone is so severe that you can’t be expected to work for more than a year, Social Security may favor your claim.

Not following the prescribed treatment

If you fail to follow what your physician has prescribed for you, or if you even neglect your doctor’s appointments, the SSA may see this as a sign that you are unwilling to help yourself. This is grounds for denying benefits. However, the SSA may excuse this kind of behavior if you present what are considered acceptable reasons. Examples are if your illness is so severe that it is extremely difficult to comply with therapy, or if you can’t afford the prescribed treatment.

Not cooperating

It goes without saying that cooperating with the SSA is crucial for a disability application. Sadly,many claimants fail to do this. Some don’t show up at the SSA-scheduled consultative exams. Some refuse to give the agency permission to access their medical files. Others simply fail to provide the agency with reachable contact details. This is a heartbreaking mistake. If the SSA cannot find you or contact you, it’s a simple yet concrete reason to deny your claim.

This is why it is important to understand the SSA’s rules and requirements, and to be meticulous in complying with them. Be diligent in communicating with the agency if there is any significant change in your situation – for example, if you need to reschedule your consultative exam or if you changed your address. If there are guidelines or forms that you don’t understand, don’t hesitate to ask a knowledgeable attorney for help.

If you’re in Virginia or northeastern North Carolina, you can talk to us at the Gillette Law Group. We are always glad to help claimants like you succeed. We can assist you in putting together a strong initial claim, or help you resolve issues in your appeal. Give us a call today at (855) 654-8130.